By Gilbert Abela

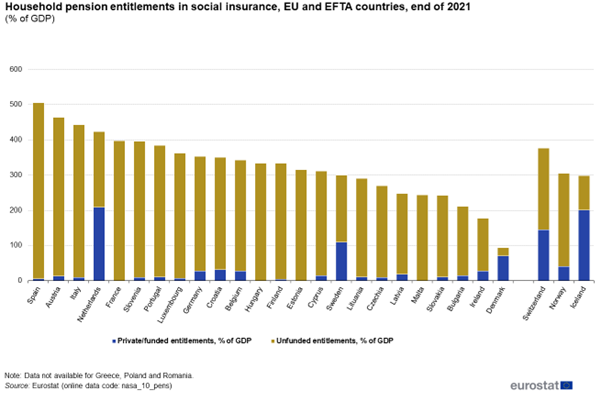

We are accustomed to hearing about government debt levels and annual deficits. However, a more significant debt obligation needs to be addressed. This is the Maltese government's obligation to pay current and future pensioners. According to the Enhanced reporting on pension report from the Eurostat[1], the Maltese government's obligation to pay current and future pensioners is substantial, amounting to 244% of its GDP as of 2021. Malta uses an unfunded pension model which relies on current worker contributions to finance current retirees. Funded pensions invest contributions in assets to generate returns to ensure they can meet future pension entitlements.

Source:https://ec.europa.eu/eurostat/statistics-explained/images/3/32/F1Household_pension_entitlements_in_social_insurance,_EU_and_EFTA_countries,_end_of_2021.png

Elsewhere in Europe, Spain's unfunded pension entitlements amount to 501% of GDP. Norway stands out for setting up an investment fund to support the pension system, reducing the unfunded portion to 264% of GDP. The Netherlands, Sweden, Switzerland and Iceland have privately held pension funds embedded into the national pension system, thus reducing the burden on the central government. On the other side of the Atlantic, US pensions boast a significantly higher aggregate funding level, currently at 79.4% according to the Milliman Public Pension Funding Index[2] as of June 2024. With their accumulated assets, funded pension systems create a robust pool of investable funds, including equities, due to their long-term investment horizon. The contrasting structures of pension systems on either side of the Atlantic contribute to overall disparities in liquidity in capital markets.

European countries have focused on extending the retirement age and reducing early retirement, among other measures, to reduce future pension entitlements. Most European countries, including Malta, promote or incentivise voluntary private pension schemes. Norway's pension system stands out due to its unique sovereign wealth fund, the Government Pension Fund Global, nicknamed the "Oil Fund". The Oil Fund invests Norway's surplus oil revenue abroad for future generations. The Oil Fund does not directly pay out pensions, but its investment returns significantly contribute to the national budget.

Malta could expand the role of Malta's National Development and Social Fund (NDSF) to fund the pension system. The NDSF receives funding from sources like the Individual Investor Programme and channels funds towards specific national development projects, social initiatives and undertaking investments. Like the Norwegian Oil Fund, which invests oil revenue to sustain the Norwegian's pensions, Malta could use its NDSF funds to save for future pension entitlements. Shifting the NDSF's goals to fund Malta's underfunded pension system could yield significant long-term benefits. Timely public access to financial reports of these funds is crucial for building trust in the effective use of public investments. Increased contributions towards these funds could bolster the system's solvency and ensure that current taxpayers can confidently look forward to a secure retirement.

European companies are increasingly seeking a US listing allured by the higher equity demand in pursuit of higher valuations. The NYSE's vice chair, John Tuttle, told The Big Question at the World Economic Forum in Davos, "No matter how you look at the data, the United States is the deepest pool of liquidity and capital in the world, which has the broadest investor base."[3] This trend underscores the potential benefits of adopting or expanding funded pension systems in Europe. Increasing private pension schemes is not just a necessity for European governments grappling with demographic headwinds and rising pension costs but also a promising solution.

Emulating the Norwegian sovereign wealth fund holds considerable promise and could be a significant part of the solution. By committing resources to sovereign wealth funds or creating funded pension schemes, governments can secure sustainable income streams to meet future pension entitlements while improving demand in capital markets. This is especially relevant in the context of the Maltese capital market given the discussions underway to improve liquidity in capital markets.

The information presented in this commentary is solely provided for informational purposes. It is not to be interpreted as investment advice, or to be used or considered as an offer or a solicitation to sell/buy or subscribe for any financial instruments, nor to constitute any advice or recommendation with respect to such financial instruments. Curmi & Partners Ltd. is a member of the Malta Stock Exchange and is licensed by the MFSA to conduct investment services business.