Article by David Curmi

Much discussion is happening at the moment about the low levels of liquidity in the local equity market, with the objective being to increase this from current levels.

Liquidity is a key element of any market. Generally speaking, it is the ability of investors to convert, easily and at a low cost, their cash into an investment and vice versa.

Liquidity is critical for various reasons:

- For issuers – a liquid market provides greater attraction as it provides a venue where capital can be raised in a cost-effective manner. It reduces the cost of capital through the reduction of the liquidity premium they have to pay;

- It indicates a more efficient market therefore the expectation would be that share price valuations more accurately reflect the underlying value of the company;

- For stock exchanges higher liquidity provides a more attractive venue for companies to raise capital thereby enabling exchanges to increase their revenues;

- Economies benefit because it allows companies access to an efficient pool of capital that can be tapped to help support the growth of businesses;

- And for investors it allows them to easily buy or sell the investments they own, at an acceptable cost. Without this none of the previous points mentioned would apply;

- For investment houses like ourselves it gives us confidence that the analysis we undertake in the listed companies will translate into an actionable decision in the form of a decision to buy or sell. Without liquidity there is no point in analysing the companies as we will not be able to buy the amount of shares we want for our clients.

It is therefore in the interest of all stakeholders that there is sufficient liquidity on the market to allow it to function well, for all stakeholders. There are various attributes of market liquidity, such as the depth (quantity of securities traded), ability of prices to recover from a liquidity shock (resiliency), costs incurred in trading (tightness), time taken to execute a trade (immediacy) and intensity of trading volume impact on security prices (breadth). In this article, only the value of securities traded is being referred to, for sake of simplicity and conciseness.

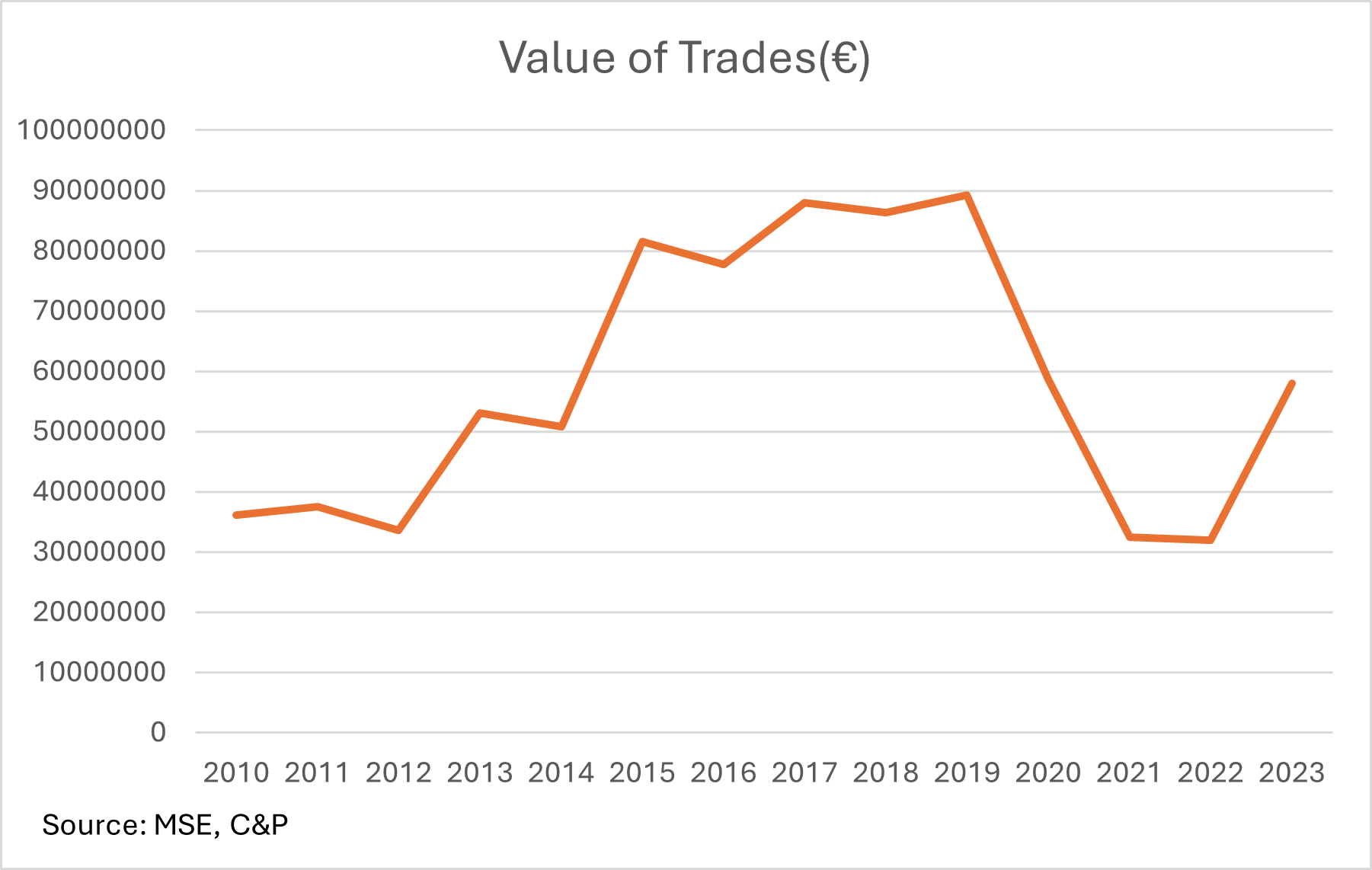

As can be seen from the chart below, the local equity market has suffered from reducing liquidity, measured by the value of trades, since its peak in 2019 (in 2023 a large single trade of some €15m is skewing the figures somewhat). This explains the concerns of the various stakeholders on the state of the local market and the potential unattractiveness of it as an investment venue. There are many actions that government, regulators, the exchange, issuers (both current and future) stockbrokers and investors can take in order to collectively improve the current situation and I urge the Malta Stock Exchange to conduct a thorough analysis on the causes for the reduced liquidity with a view to coming out with a long term plan as to how to improve this. To my mind there is no single silver bullet that will solve this so it needs to be a coming together of minds, and ideas, to collectively solve this for the benefit of all. It really is a no lose outcome if done properly.

Some of the aspects that perhaps need to be considered are as follows:

- Are listed companies delivering on their expected profitability to their wider body of shareholders? Investors are not going to be interested in investing into companies that perennially under deliver. Is management delivering value to its shareholders? This must be the starting point.

- Is there the right governance taking place, at all levels, and across all companies. There is a wide discrepancy between the transparency standards of companies – not only on paper but in practise. What can we do to improve this across all companies? The idea of doing the least possible to just be in line with the minimum standards set out by the MSE should not be the norm. We should aspire to be better.

- Are investment houses/institutions carrying out the right assessments of companies? Should there be more involvement/activism between investors and management?

- Is the cost of trading too high? Should greater technology be introduced to allow better, more cost effective and easier access to the market to continue to promote wider investment reach?

- Should the government provide more structures to promote savings, perhaps in the form of tax-free Investment Savings Plans? Is the tax regime effective in providing the right incentives?

- Are local investment houses sufficiently incentivised to participate actively on the local market?

- Can the regulator provide a better listing experience?

This is not a situation where a single tweak is going to open the liquidity taps. Case in point is the current discussion on company buy backs. Whilst helpful it will not solve the problem on its own. The approach needs to be multi faceted, both in terms of the different elements that need to be tackled, as well as the time period over which the changes are implemented. The Malta Stock Exchange is still relatively young, and has indeed come a long way since its inception in 1991. It is however time to do some critical analysis of the journey so far and put together a long term strategic plan that contains the improvements required, otherwise we will continue to witness an increased flow of monies to international securities.